The Securities and Exchange Board of India (SEBI) has taken strict action against Anil Ambani and Reliance Home Finance Limited (RHFL) for their involvement in unhindered disbursement of loans to their respective entities. Anil Ambani has been fined Rs 25 crore and barred from participating in the securities market for five years. The company has faced fines along with its key management personnel.

SEBI’s investigation, culminating in a judgment published Thursday, highlights Ambani’s central role in what he described as a “fraud scheme. The scheme involved disbursement of loans worth Rs 8,470 crore without due diligence to parties belonging to Reliance ADA Group, tagged as working capital loans.

According to Sebi, these loans were often sanctioned and disbursed on the same day they were applied for, raising severe red flags in the process. The order also pointed out the neglect of recovery of these loans, in which Ambani has been directly involved in the approval process.

In addition to the penalty, SEBI’s order has banned RHFL from accessing the securities market for six months, including other involved employees and entities. Anil Ambani has also been barred from serving as a director or manager official in any listed or registered company with SEBI.

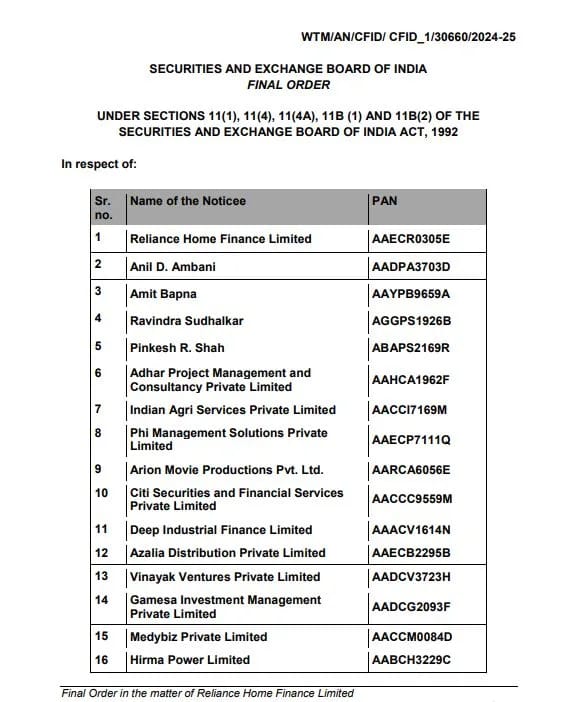

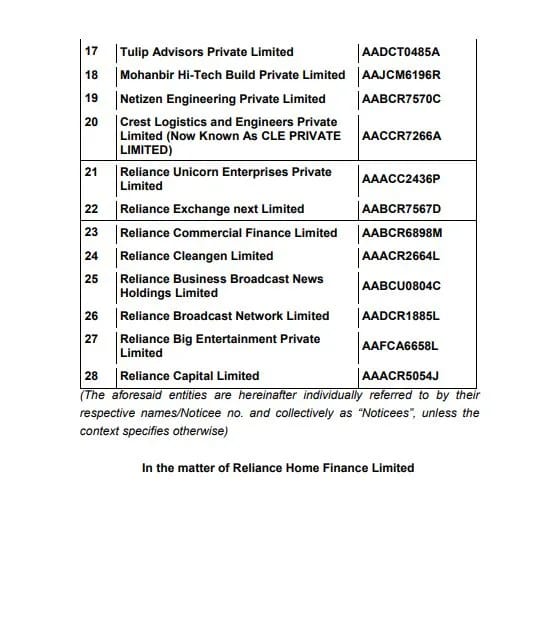

Here is a list of individuals and firms that have been banned along with Anil Ambani:

Other entities involved either obtained illegal loans or acted as middlemen to transfer funds from RHFL. Sebi’s probe confirmed that there was a fraud scheme led by Anil Ambani and it was executed by key managers of RHFL. They diverted funds from RHFL by giving fake loans to Ambani-linked entities.

The decision includes the findings of two separate reports by Price Waterhouse & Co. and Grant Thornton, pointing out significant governance failures and ethical violations in RHFL’s operations, further strengthening SEBI’s decisions.