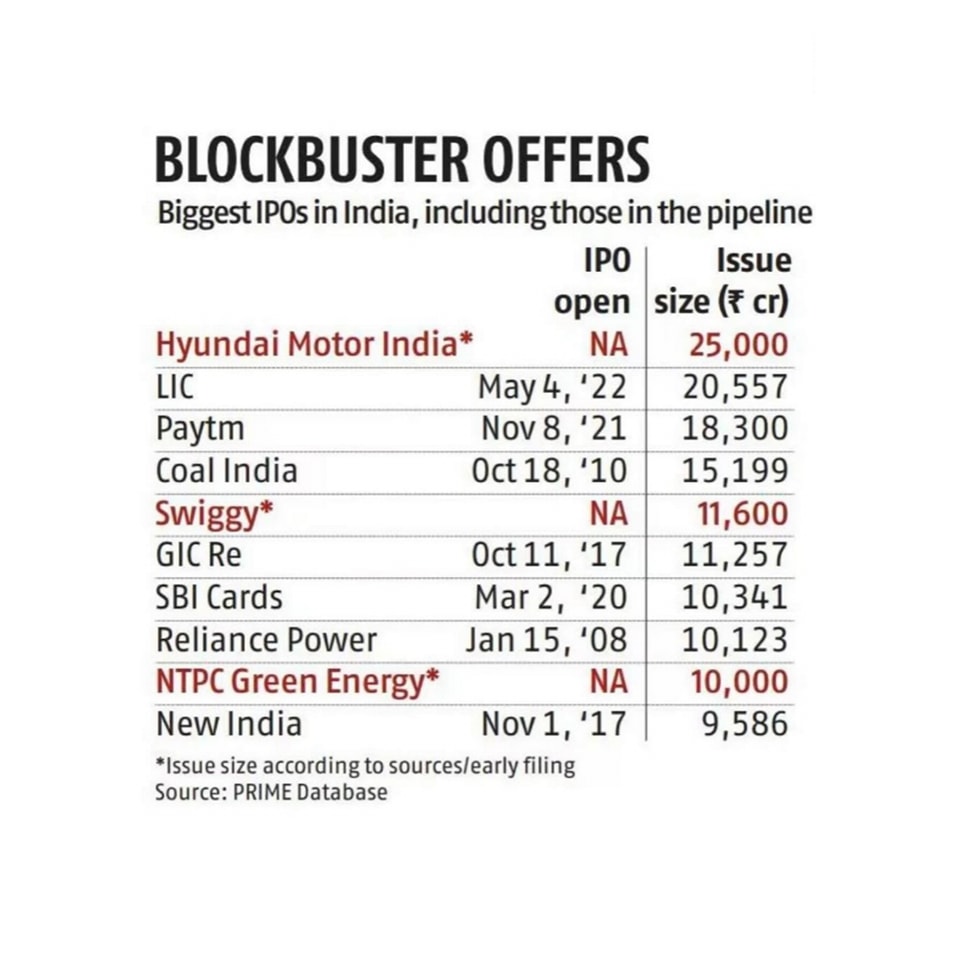

India is set to see some of its biggest IPOs in the coming months, with big names like Hyundai Motor India and Swiggy making headlines. The Hyundai Motor India IPO, which is expected to be launched in October 2024, is expected to raise around Rs 25,000 crore, making it the country’s largest IPO. This is Hyundai’s first public offering in India, aimed at boosting its market visibility and liquidity. The entire matter has been put up for sale by the promoter and the proceeds will allow the company to leverage its already strong position in the Indian automotive market.

Both Hyundai Motor India Limited and Swiggy have received approval from the Securities and Exchange Board of India (SEBI) to go ahead with their initial public offerings (IPOs), marking significant developments in the Indian capital market.

South Korean automotive major Hyundai Motor India aims to raise at least $3 billion (about Rs 25,000 crore), potentially making it the largest IPO in India’s history, surpassing the Rs 21,000 crore raised by LIC in 2022.

The offer will be entirely an offer for sale (OFS) of 142.19 million equity shares from its parent company Hyundai Motor Company. Since it is an OFS, Hyundai Motor India will not get any revenue from the IPO.

Hyundai’s IPO is particularly noteworthy as it is the first automaker IPO in two decades since Maruti Suzuki’s listing in 2003. The South Korean automaker hopes that the list will boost its popularity and brand image in the Indian market, where it currently stands as the second largest carmaker after Maruti Suzuki.

Also watch video: Top 10 Upcoming IPO : NTPC Green Energy IPO | Hyundai IPO | Swiggy IPO | HDB Financial Services IPO

Meanwhile, food and grocery delivery company Swiggy is preparing for its IPO, valued at over Rs 10,000 crore. Swiggy had filed its DRHP secretly in April 2023, and after getting approval from shareholders, it is now expected to raise Rs 10,414 crore through a combination of new equity shares (Rs 3,750 crore) and OFS (Rs 6,664 crore).

This filing follows a systematic process where Sebi reviews the confidential draft, after which a public release is issued for comments before finalizing the offer.

The approval of both IPOs reflects the boom in the capital market in India, where around 60 companies have already launched IPOs this year.

The development is set to make a significant impact, especially as Hyundai Motor India is likely to make history with the largest ever IPO in the country, while Swiggy’s listing will reinforce the power of India’s growing tech and startup ecosystem.

Also read: Noel Tata, Ratan Tata’s half-brother, has been appointed as new Chairman of Tata Trusts.