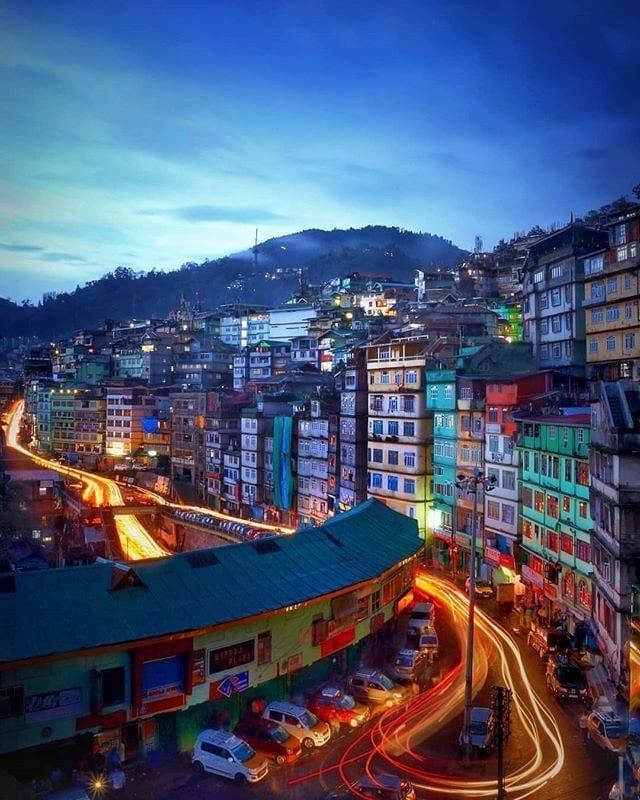

With the deadline for filing income tax returns (ITRs) approaching july 31, 2024, it is interesting to note that india’s northeastern state of Sikkim has a unique income tax exemption that is not available to residents of any other state. This special status has brought Sikkim into the limelight on social media platforms, with many users discussing its tax exemption benefits.

A user on X (former Twitter) commented humorously, “Forget Dubai! Somebody give me sikkim resident status. How much will you get, brother?” said another person, ‘Pay zero tax… Yes, you read it right!! Become a resident of Sikkim.

These posts indicate curiosity and interest in Sikkim’s separate tax system, stemming from its unique historical arrangements with India. When Sikkim merged with India in 1975, it retained certain sovereign features, including the tax rules established under the 1948 Sikkim Income Tax Manual.Though these specific regulations were repealed by the Union Budget in 2008, the introduction of Section 10(26A) in the Income Tax Act ensured the retention of tax exemptions for Residents of Sikkim.

This exemption allows residents to avoid paying income tax on income from within the state, including income from interest on securities, dividends and other sources. However, it is important to note two important conditions:

1] The income should be earned within Sikkim. Income from outside the state is not eligible for exemption.

2] In 2008, the Supreme Court had upheld the condition that if a woman from Sikkim marries a non-Sikkimese man, she loses her tax-exempt status.

Further, Sikkimese residents also benefit from a SEBI regulation exempting them from the mandatory PAN condition for investing in Indian securities and mutual funds, adding another layer to their unique financial incentives.

Also read: Did ‘The Simpsons’ predict Kamala Harris as next US President?